How to Pay for a New Roof: Homeowner’s Guide

A new roof is one of the largest investments you can make when it comes to your property. Whether you’re dealing with hail or storm damage, old age, or you're looking to create some curb appeal, replacing your roof is a necessary evil. Many homeowners wonder how to pay for a new roof, especially when the cost can range from several thousand dollars to tens of thousands, depending on size, material, and complexity.

The good news is that there are several ways to manage the financial side of roofing projects. From insurance coverage to financing, loans, and savings strategies, this guide will walk you through everything you need to know about paying for a new roof without unnecessary stress.

Why Roof Replacement Costs A Lot

Before figuring out how to pay for a new roof, it’s important to understand where the cost comes from. Roofing isn’t just about laying down some shingles - it’s a full system that protects your home.

Factors that affect the price of a roof replacement include:

Size of the roof (measured in “squares” - 100 sq. ft. each).

Roofing material (Asphalt shingles, metal, slate, tile, wood shake, etc.)

Labor costs (skilled labor, regional pricing differences).

Roof pitch and complexity (steep roofs, multiple valleys, dormers, or chimneys increase difficulty)/

Tear-off cost (removing old roofing materials).

Underlayment, ventilation, and flashing upgrades.

Location and permitting fees.

According to Angi Powered By HomeAdvisor, “You can typically expect to pay between $5,870 - $13,223 to install a new roof, depending on size and materials.”

Step 1. Check Your Insurance Provider

One of the first steps in figuring out how to pay for a new roof is determining if insurance can help.

Storm & Hail Damage Coverage: If your roof was damaged in a storm recently, homeowners’ insurance may pay for repairs or replacement.

Age of Roof: Some policies reduce or deny coverage if the roof is over 20 years old.

Exclusions: Half-done work, neglect, or improper installation are usually not covered.

Tip: Always file a claim as soon as possible after damage. An insurance adjuster will inspect your roof to determine eligibility.

**Insurance may not cover the entire cost, but it can significantly reduce your out-of-pocket expense.

Step 2: Explore Secure Financing Options

If insurance doesn’t cover your roof, or only covers part of it, financing can be a smart solution. Roofing companies often partner with lenders to provide payment options.

Common financing choices include:

Personal Loans

Unsecured, meaning no collateral is needed.

Fixed monthly payments.

Approval based on credit score.

Can be used for the entire cost of the roof.

Home Equity Loans of HELOCs (Home Equity Line of Credit)

Secured against your home’s equity.

Typically lower interest rates than personal loans.

Longer repayment terms.

Good option if you have significant equity built up.

Roofing Company Payment Plans

Many roofing contractors offer in-house financing or third-party plans.

May include low-interest or even 0% promotional financing for qualified buyers.

Convenient, since it’s arranged directly through the roofer.

Credit Cards

FHA Title I Loans allow homeowners to finance home improvements, including roofs.

Some local municipalities offer grants or low-interest loans for energy-efficient roofs.

Government Loans or Assistance Programs

FHA Title I loans allow homeowners to finance home improvements, including roofs.

Some local municipalities offer grants or low-interest loans for energy-efficient roofs.

Step 3: Saving Strategies for a Roof Replacement

Not everyone is able to finance a new roof. Some homeowners prefer to save and pay cash. If you’re planning ahead, here are strategies to set aside money:

Start A Roof Savings Fund: Open a separate account just for home repairs. Deposit a fixed amount every paycheck.

Tax Refunds or Bonuses: Allocate windfalls directly to your roof fund.

Energy Savings Programs: Some energy-efficient upgrades may qualify for tax credits.

Cut Unnecessary Expenses: Redirect money from subscriptions, dining out, or luxury purchases.

While saving takes time, it’s one of the least stressful ways to pay for a roof because you avoid debt.

Step 4: Split the Cost Into Stages

If your roof isn’t in immediate danger of failing, you may be able to spread the cost over time:

Replace only one section of the roof now (if the rest is still in decent condition).

Do necessary repairs immediately, then complete a full replacement when finances allow.

Upgrade gradually - for example, replacing gutters and ventilation during one phase, shingles later.

This approach requires careful planning and coordination with a roofing contractor, but it can make costs more manageable.

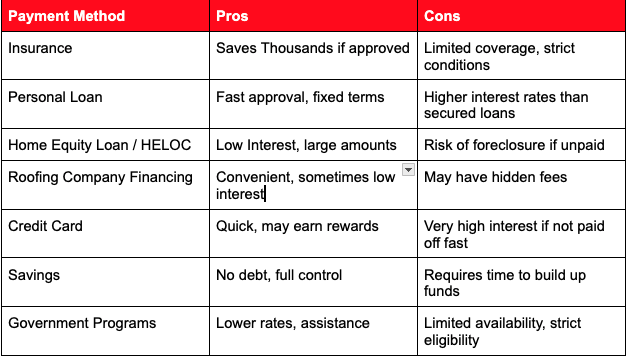

Comparing Payment Options

Here’s a quick look at how different payment methods stack up:

Table of Pros and Cons for Different Payment Methods for Roof

Negotiating with a Roof Inspector

Another overlooked part of figuring out how to pay for a new roof is negotiation. While roofing costs are based on materials and labor, there may be room to save on labor costs, but that could mean a cheaper quality roof.

When Determining Your Roofing Bill:

Get multiple eyes on it. Multiple inspections and quotes to determine the best option.

Ask about seasonal discounts-roofers may charge less in slower months,

Check for manufacturer promotions (like rebates on shingles).

Bundle Repair - fixing gutters or insulation at the same time can reduce labor costs.

Ask about material alternatives - mid-tier shingles may look and perform almost as well as premium lines for less money.

Long-Term Savings: Think Beyond the Roof

When deciding how to pay for a new roof, remember that the right choice can save you money long term.

Energy-efficient shingles reduce utility bills.

Durable materials (like metal or premium asphalt) may cost more upfront but last longer, saving on future replacements.

Proper installation reduces maintenance and repair costs down the road.

Investing wisely now means fewer financial headaches later.

Signs It’s Time to Replace Your Roof

It’s easier to manage roof costs if you plan instead of waiting for an emergency. Watch for these signs:

Shingles curling, cracking, or missing.

Granule loss (bald spots on shingles).

Leaks in the attic or ceiling stains.

Roof over 20 years old.

Sagging areas or visible structural damage.

If you notice these, start researching how to pay for a new roof before the problem becomes urgent.

Common Questions About Paying for a New Roof

-

Yes, some roofing companies offer flexible financing options. Home equity loans may also work if you have property equity.

-

Generally no, unless it’s part of a home office or rental property expense. However, energy-efficient upgrades may qualify for tax credits.

-

If your roof is failing, protecting your home takes priority. An emergency fund is designed for critical situations like this.

-

Yes, ask your roofer or lender about interest rates, payment schedules, and promotional offers.

A Payment Plan Just for You

Ultimately, not all properties are the same, so there’s no one answer to how to pay for a new roof. The best choice depends on your financial situation, credit history, and how urgently the roof needs to be replaced.

For some, insurance will cover the majority of costs. For others, financing spreads the payment into manageable monthly installments. And for planners, saving ahead of time is the most stress-free method. (217)772-1149